Small businesses are the backbone of the economy, and funding is crucial to their success. However, getting a loan for a small business can be a challenging and frustrating process. It is not uncommon for lenders to deny loan applications, even when you know you have a great business idea. Here we will explore the reasons why small business funding can be complicated, as well as some tips on how to increase your chances of approval.

Why is small business funding so complicated?

Small business funding can be complicated for several reasons. Firstly, small businesses are inherently risky. They have a higher failure rate than larger businesses, and lenders are often hesitant to take on that risk. Secondly, many small business owners do not have a solid credit history, which can make it challenging to secure funding. Finally, lenders often have strict lending criteria that small businesses may not meet.

What can you do when lenders don’t recognize the potential of your project?

If lenders don’t recognize the potential of your project, it can be disheartening. However, there are several things you can do to increase your chances of approval. Firstly, you can consider alternative forms of funding, such as crowdfunding or angel investors. Crowdfunding allows you to raise funds from a large number of people, often through online platforms. Angel investors are wealthy individuals who invest in startups in exchange for equity.

Another option is to work on improving your credit score. This can be done by paying off any outstanding debts, paying bills on time, and reducing your credit utilization ratio. A good credit score can make you a more attractive candidate for lenders.

It is also essential to have a solid business plan in place. This should include a detailed description of your business, market research, financial projections, and a plan for repaying the loan. A well-prepared business plan can demonstrate to lenders that you are serious about your business and have a clear vision for its success.

Finally, it may be worth seeking the help of a small business advisor. They can provide guidance on business funding options, help you prepare your business plan, and even introduce you to potential investors.

What can you do when lenders won’t sit down with you to discuss your small business funding needs?

If lenders won’t even sit down with you to discuss your small business funding needs, it can be frustrating. However, there are several things you can do to increase your chances of getting a meeting.

Firstly, make sure your loan application is complete and includes all the necessary documents. This should include your business plan, financial statements, and tax returns.

Providing all the required information upfront can demonstrate to lenders that you are serious about your business.

Secondly, consider reaching out to lenders who specialize in small business funding. These lenders often have more lenient lending criteria and may be more willing to meet with you to discuss your needs.

Finally, it may be worth seeking the help of a loan broker. Loan brokers can help you identify lenders who are a good fit for your business and can even negotiate better terms on your behalf.

Let’s start with the basics. Backbone America has a plethora of articles to help you get the funding you need to start or grow your business. If that’s not enough, we’ll even help you through the process.

Tips on Getting Your Business Funded

The Importance of Pricing Strategies in Marketing

The Importance of Pricing Strategies in Marketing Small businesses are vital to the US Economy. That's why small businesses are called the Backbone of the America. Even so, most small businesses with no employees average [...]

Start Up Business Loans for Small Businesses

Finding Start Up Business Loans One of the favorite parts of my job as a business advisor is helping entrepreneurs find start up business loans. Big loans, small loans... it doesn't matter. To me, helping [...]

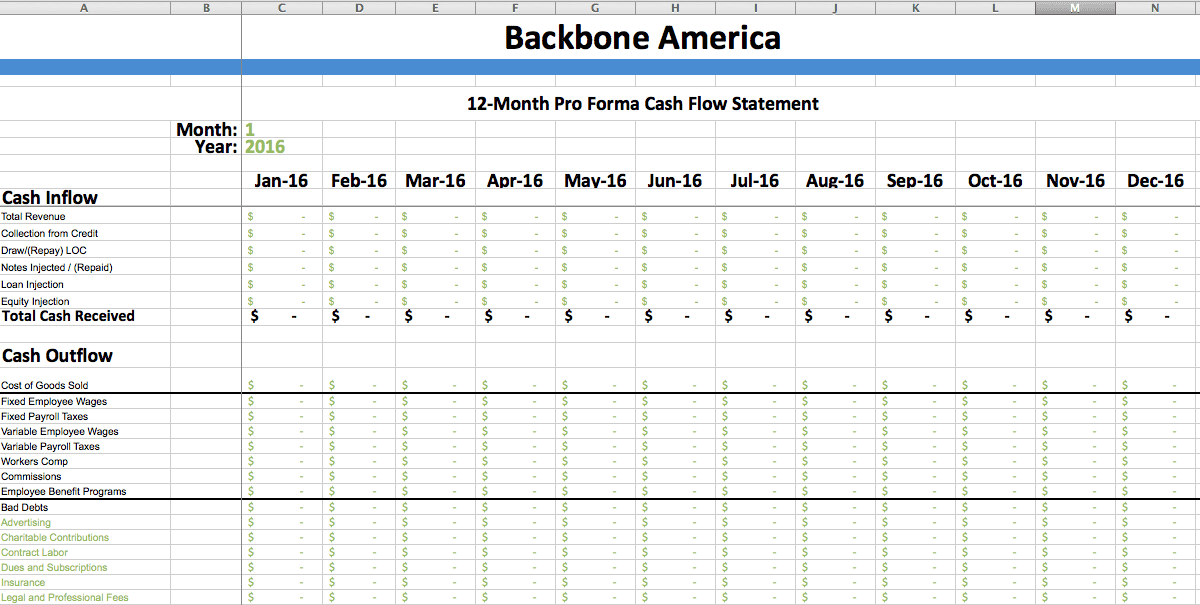

Playing the Cash Flow Game – Template Included

Playing the Cash Flow Game - Template Included One of the last things I address when building a set of financials is the cash flow. For me, it's like a cash flow game in that [...]

Personal Guarantee Clause – Giving Your Business a Leg Up

Personal Guarantee Clause - Giving Your Business a Leg Up A big piece of my job is finding funding for my clients. The funding I find for them can come in a variety of forms, [...]

Financial Health in the Startup Funding Stages

Financial Health in the Startup Funding Stages Business financials... where to start? First, I'll say the financial health in the startup funding stages of your company starts well before going into business. Why do I say [...]

Who Uses Financial Statements? and why…

Who Uses Financial Statements? and why... The idea having financial statements for a business may be a new concept for some. I've have plenty of clients who've started their businesses without them. They simply draw [...]

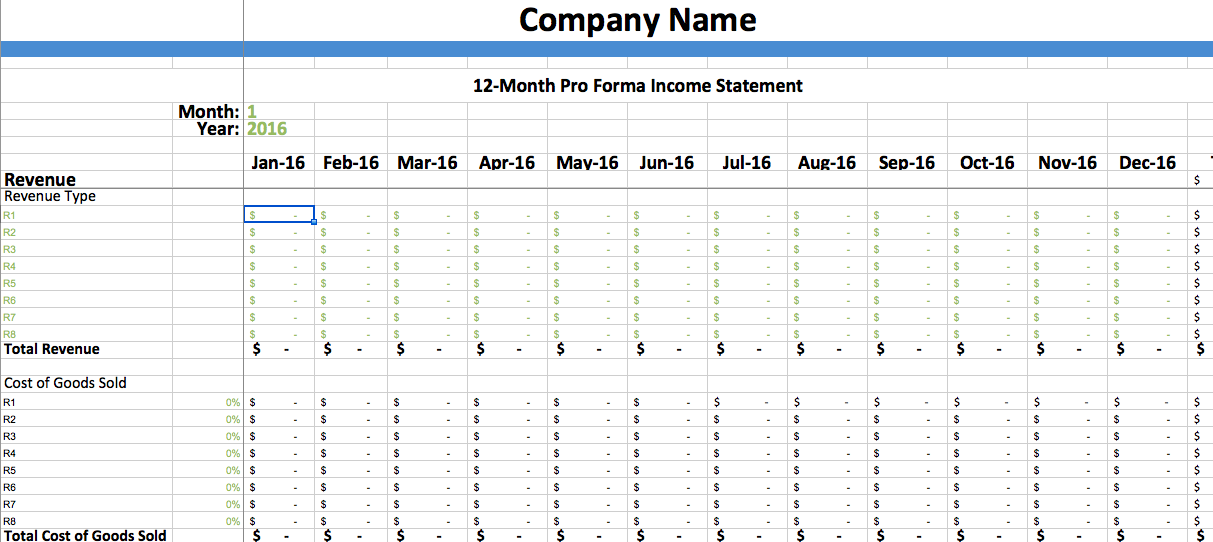

Pro Forma Income Statement Template – Dumbing It Down

Pro Forma Income Statement Template - Dumbing It Down I always find the name income statement to be odd. To me, the name sounds like it's just tracking revenue, when in actuality, it tracks [...]

Break Even Analysis Formula – Online Calculator

Break Even Analysis Formula - Online Calculator When it comes to the break even analysis formula, goal setting comes to my mind. So exactly what is break even? Well, it's the point where your [...]

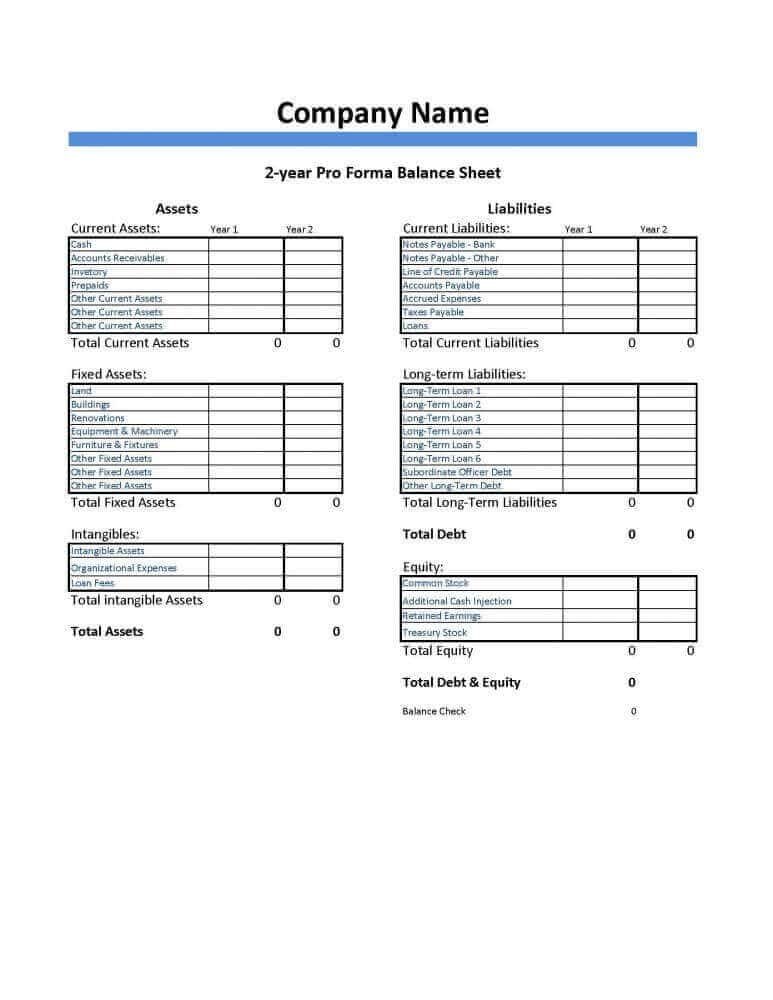

Pro Forma Balance Sheet Template – Dumbing It Down

Pro Forma Balance Sheet Template - Dumbing It Down If you read the Business Startup Page, you'll know playing with financials is one of my favorite aspects of being a business advisor. So today, [...]