[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text][/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”yes” menu_anchor=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”0px” padding_right=”” padding_bottom=”0px” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

NOT ONLY HAVE CONFIDENCE WHEN YOU GO TO INVESTORS, BUT ALSO GIVE THE INVESTORS THE CONFIDENCE THEY NEED IN YOU AND YOUR BUSINESS

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#1a80b6″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

Investor-ready business Plan for Women

[/fusion_text][fusion_text][/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]There are quite a few different challenges which come with starting your own business or growing the one that you already have. A lot of entrepreneurs mistakenly believe that a business plan is only used when you are starting your company. On the contrary, you should update your business plan regular, in order to keep yourcompany on with achieves its goals.

Your business plan serves another purpose. There may be times when your company faces serious financial challenges (though you and I both hope that never comes to be) or may need additional capital to take your business to the next stage.The thing is, the chances that you’ll need some sort of financial assistance at some point in the lifespan of your business is high. With this in mind, one of the most effective ways of getting capital quick and free of a lot of burden is through one or more investors. When I say investors, that can be lenders, grantors, angel investors, and other capital investors.

Here is where an investor-ready business plan will be of great benefit. There are a lot of things that your potential investor is going to want to see before providing you capital for your business.[/fusion_text][fusion_tagline_box backgroundcolor=”” shadow=”no” shadowopacity=”0.7″ border=”1″ bordercolor=”” highlightposition=”left” content_alignment=”left” link=”#modalprocess” button=”Get Started” linktarget=”_self” modal=”modalprocess” button_size=”” button_type=”” button_shape=”” buttoncolor=”default” title=”Gaining the confidence of lenders isn’t always so straightforward” description=”Let us help you improve your odds of obtaining a loan” margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” /][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text][contact-form-7 id=”11829″ title=”Business Plan”][/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_content_boxes layout=”icon-with-title” columns=”1″ title_size=”” title_color=”” body_color=”” backgroundcolor=”” iconcolor=”” icon_circle=”” icon_circle_radius=”” circlecolor=”” circlebordersize=”” circlebordercolor=”” outercirclebordersize=”” outercirclebordercolor=”” icon_size=”” icon_hover_type=”” hover_accent_color=”” link_type=”” link_area=”” link_target=”” icon_align=”left” animation_type=”” animation_delay=”” animation_offset=”” animation_direction=”left” animation_speed=”0.3″ margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_content_box title=”Outlining the course of action” backgroundcolor=”rgba(7,169,244,0)” icon=”” iconflip=”” iconrotate=”” iconspin=”no” iconcolor=”” circlecolor=”” circlebordersize=”” circlebordercolor=”” outercirclebordersize=”” outercirclebordercolor=”” image=”” image_width=”35″ image_height=”35″ link=”” linktext=”Read More” link_target=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Undoubtedly, one of the most important things that you would have to do is to outline your course of actions. Setting the goal are important, but investors are interested in the way that you will manage the money they give you and your ability to handle the challenges, which will undeniably come.

Outlining your course of action means that you have set clear objectives that you want to meet but most importantly – outline how you are going to get there. This is going to bring merit to your demands and it is going to provide investors with a clear idea of the return on investment they can expect.[/fusion_content_box][fusion_content_box title=”Equity,Ownership, or Profits” backgroundcolor=”” icon=”” iconflip=”” iconrotate=”” iconspin=”no” iconcolor=”” circlecolor=”” circlebordersize=”” circlebordercolor=”” outercirclebordersize=”” outercirclebordercolor=”” image=”” image_width=”35″ image_height=”35″ link=”” linktext=”” link_target=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

You can provide investors some assurance that they’ll receive a return on their investments in a couple of ways, equity (personal or from your company) or profits and a solid business plan. Personal equity is great, as it shows investors you’re putting yourself at risk, which means you’re likely to do everything it takes to succeed.

Equity in your company might mean providing a percentage of your business to investors. Usually, company equity comes into play when investors see the potential to gain a large return on investment. This may also be an option if you’re looking to expand quickly. However, it often means you’ll give up at least some control of the way your company operates.

Another way to provide a return on investments is through profits. In this case, you provide investors with a percentage of the revenue generated (may be net, gross, or any other arrangements outlined in your contract) until the investors receives their agreed upon return or for a larger period of time, which all depends on the terms that you manage to negotiate.

In any case, an investor-ready business plan is undeniably one of the most important things that you will need in order to attract investors to fund your business. It is going to provide investors with the necessary information they will need to make a decision, and in most cases, you won’t even have a shot at winning them over without one. If you need funding and don’t have a business plan, dedicate the time and hard work to putting one together or seek the help of a professional.

[/fusion_content_box][/fusion_content_boxes][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”20″ padding_right=”20″ padding_bottom=”20″ padding_left=”20″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”rgba(96,125,139,0.38)” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px 30px 30px 30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Purpose of Investor-Ready Business Plans

[/fusion_text][fusion_text]Investors typically won’t even consider providing funding to you if you don’t have a solid business plan. Whether you’re applying for traditional bank lending, gap lending, grants, angel investors, or other funding opportunities, having a solid business plan can be the difference between a “yes” or a “no.” Your business plan has the potential to open doors that would not be otherwise available.

When it comes to investors, one of the most important aspects of the business plan are the financial projections. Yes, your idea is important and all the other details that go into the business plan. However, let’s really look at the word “investor.” According to the Cambridge dictionary, investor means “a person or group of people that puts its money into a business or other organization in order to make a profit.” Your financial projections give them an idea of if your business is going to be profitable to them. Keep in mind, profitable isn’t always about how much money your company will make for the investor, but it could be. Depending on the type of funding you seek, the profits can be in supporting a community, job development, or some other element that supports the missions of a speciality group.[/fusion_text][fusion_button link=”http://themeforest.net/item/avada-responsive-multipurpose-theme/2833226?ref=ThemeFusion” title=”” target=”_blank” alignment=”center” modal=”pricingmodal” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”custom” button_gradient_top_color=”rgba(255,255,255,0)” button_gradient_bottom_color=”rgba(255,255,255,0)” button_gradient_top_color_hover=”rgba(255,255,255,.1)” button_gradient_bottom_color_hover=”rgba(255,255,255,.1)” accent_color=”rgba(255,255,255,.8)” accent_hover_color=”#ffffff” type=”flat” bevel_color=”” border_width=”1px” size=”large” stretch=”default” shape=”round” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]PURCHASE YOUR SOLUTION[/fusion_button][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”0″ bottom_margin=”0″ border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”200px” alignment=”center” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no” element_content=””][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”yes” menu_anchor=”planningprocess” hide_on_mobile=”no” class=”fusion-menu” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”0px” padding_right=”” padding_bottom=”0px” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”1″ content_align=”center” style_type=”default” sep_color=”#1a80b6″]

WE KNOW HOW TO ATTRACT SMALL BUSINESS INVESTORS

[/fusion_title][fusion_tabs design=”clean” layout=”horizontal” justified=”yes” backgroundcolor=”” inactivecolor=”” bordercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_tab title=”Investor-Ready Audit” icon=”fa-money”]

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ last=”no” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”solid” padding=”” class=”” id=””][fusion_imageframe lightbox=”right” style_type=”none” bordercolor=”” bordersize=”0px” borderradius=”” stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”left” animation_speed=”1″ class=”” id=””]

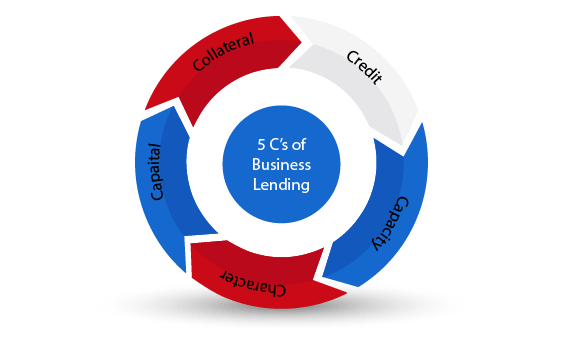

Our 5-Step process begins with a Investor-Ready Audit. We’ll look at how [fusion_popover title “5 C’s of Business Lending” title_bg_color=”” content=”We’ll help you evaluate your credit, capital, capacity, collateral, and character.” content_bg_color=”” bordercolor=”” textcolor=”#800000” trigger=”hover” placement=”top” class=”id””] prepared you are to go for funding[/fusion_popover] and help you determine your next steps for gaining the capital you need to get your business off to the right start. In your 1-hour Bank-Ready Audit, you’ll also receive valuable tips to assist you in improving your financial position.

Your investor-ready audit will give you the knowledge you need to present yourself in the best possible light when you approach investors.

[/fusion_text][fusion_separator style_type=”none” top_margin=”10″ bottom_margin=”10″ sep_color=”” icon=”” width=”” class=”” id=””/][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_tab][fusion_tab title=”Information Gathering” icon=”fa-question”]

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ last=”no” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”solid” padding=”” class=”” id=””][fusion_imageframe lightbox=”right” style_type=”none” bordercolor=”” bordersize=”0px” borderradius=”” stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”left” animation_speed=”1″ class=”” id=””]

[/fusion_imageframe][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ last=”yes” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”” padding=”” class=”” id=””][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”5″ sep_color=”” icon=”” width=”” class=”” id=””/][fusion_text]

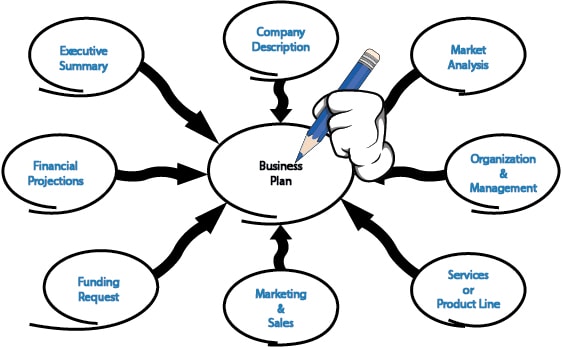

This stage is one of the most crucial stages in the business planning process. Your business plan is a representation of your business idea and vision. It’s important to us that we get to know you and your business. That’s why we work closely with you and your team to capture the elements that make your company unique. We’ll review your current documents and ask the right questions for each [fusion_popover title=”Segments of a Business Plan” title_bg_color=”” content=”Executive Summary, Company Description, Market Analysis, Organization & Management, Service or Product Line, Marketing & Sales, Funding Request, Financial Projections.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”top” class=”” id=””]segment of your business plan.[/fusion_popover]

Our information sessions are convienetly conducted over a series of phone calls or Skype interviews, so you can participate from the comfort of your office or home.

[/fusion_text][fusion_separator style_type=”none” top_margin=”10″ bottom_margin=”10″ sep_color=”” icon=”” width=”” class=”” id=””/][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_tab][fusion_tab title=”Research” icon=”fa-book”]

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ last=”no” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”solid” padding=”” class=”” id=””][fusion_imageframe lightbox=”right” style_type=”none” bordercolor=”” bordersize=”0px” borderradius=”” stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”left” animation_speed=”1″ class=”” id=””]

During this phase, we take the information we’ve gathered from you and your team and supplement it with heavy research. We’ll research your industry, target market, [fusion_popover title=”Competitive Analysis” title_bg_color=”” content=”Our competitive analysis examines the characteristics of 3-5 business in your industry. We analyze companies identified by you and/or revealed through our research” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”top” class=”” id=””]competition[/fusion_popover], and alert you to potential regulatory concerns we uncover. After our thorough examination of our findings, we’ll provide any recommendations that might enhance the success of your business.

Having a background in information system, we know the importance of good data. After all, garbage in = garbage out (GIGO). The business plan we develop for you will be thorough, accurate, and reliable.

[/fusion_text][fusion_separator style_type=”none” top_margin=”10″ bottom_margin=”10″ sep_color=”” icon=”” width=”” class=”” id=””/][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_tab][fusion_tab title=”Write” icon=”fa-pencil”]

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ last=”no” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”solid” padding=”” class=”” id=””][fusion_imageframe lightbox=”right” style_type=”none” bordercolor=”” bordersize=”0px” borderradius=”” stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”left” animation_speed=”1″ class=”” id=””]

[/fusion_imageframe][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ last=”yes” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”” padding=”” class=”” id=””][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”5″ sep_color=”” icon=”” width=”” class=”” id=””/][fusion_text]

You will always know the status of your business plan, because in this stage, you’re involved every step of the way. We take all the information gathered and research completed and begin drafting your plan. As we complete each segment, we submit it to you for review. While you review, we work on the [fusion_popover title=”Typical Order of Development” title_bg_color=”” content=”Company Description, Market Analysis, Organization & Management, Services or Product Line, Marketing & sales, Funding Request, Financial Projections, Executive Summary” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”top” class=”” id=””]next segment[/fusion_popover]. This process allows us to always be moving forward with little to no down time.

By constantly staying in communication and collaborating, you know the final draft of your business plan will be exactly what you want.

[/fusion_text][fusion_separator style_type=”none” top_margin=”10″ bottom_margin=”10″ sep_color=”” icon=”” width=”” class=”” id=””/][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_tab][fusion_tab title=”Review” icon=”fa-pencil”]

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ last=”no” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”solid” padding=”” class=”” id=””][fusion_imageframe lightbox=”right” style_type=”none” bordercolor=”” bordersize=”0px” borderradius=”” stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”left” animation_speed=”1″ class=”” id=””]

[/fusion_imageframe][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ last=”yes” spacing=”yes” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_size=”0px” border_color=”” border_style=”” padding=”” class=”” id=””][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”5″ sep_color=”” icon=”” width=”” class=”” id=””/][fusion_text]

The final stage of development is the review of your completed business plan. Over the next 30 days, we’ll make unlimited revisions until you’re 100% satisfied with your business plan. We start by providing you a copy of your draft business plan to examine. Then we [fusion_popover title=”Your Review Appointment” title_bg_color=”” content=”We usually schedule this appointment about a week out to provide you time to review your business plan.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”top” class=”” id=””]schedule an appointment[/fusion_popover] to discuss and fine tune your business plan, as well as answer any questions you may have.

Not only will you walk away with a investor-ready business plan, but you’ll also leave with a roadmap for success.

[/fusion_text][fusion_separator style_type=”none” top_margin=”10″ bottom_margin=”10″ sep_color=”” icon=”” width=”” class=”” id=””/][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_tab][/fusion_tabs][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”rgba(96,125,139,0.54)” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

The importance of a SOLID Business Plan

[/fusion_text][fusion_text]

If you’ve ever gone on a road trip to an unfamiliar destination, you know how important navigation is. You likely use a map, GPS, voice navigation, a buddy who’s familiar with the location, or some other method. The point is, you probably have guidance to reach your destination. When it comes to your company, your business plan is like a roadmap. Your vision for your company is the destination. Trying to build a successful company without a vision or business plan is equivalent to starting a long journey to some place grand but not knowing what that place is our how to get there. Basically, it amounts to crossing your fingers and hoping you happen upon an amazing place by coincidence. That serendipity will grace your and your business.

Here’s the flip side. Companies with business plans are twice as likely to succeed. Considering the challenges of starting, running, and growing a profitable business, you want to have a business plan that’ll double your chances of developing a healthy business. Doesn’t the time, effort, money, and resources you put into your company deserve a return on investment? Well, you increase your odds with a business plan.

[/fusion_text][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”20″ width=”200px” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” margin_top=”15px” margin_bottom=”15px” admin_toggled=”no”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_separator style_type=”none” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”https://backboneamerica.com/wp-content/uploads/2017/06/multiethnic-group-of-young-business-people-creating-presentation-and-using-laptop-together-in-office.jpg” background_position=”right center” background_repeat=”no-repeat” fade=”no” background_parallax=”left” enable_mobile=”no” parallax_speed=”0.6″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”120px” padding_right=”” padding_bottom=”120px” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”rgba(96,125,139,0.54)” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

The Right Tools For The Right Solution. Every Time.

[/fusion_text][fusion_button link=”” title=”” target=”_blank” alignment=”center” modal=”pricingmodal” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”custom” button_gradient_top_color=”rgba(255,255,255,0)” button_gradient_bottom_color=”rgba(255,255,255,0)” button_gradient_top_color_hover=”rgba(255,255,255,.1)” button_gradient_bottom_color_hover=”rgba(255,255,255,.1)” accent_color=”rgba(255,255,255,.8)” accent_hover_color=”#ffffff” type=”flat” bevel_color=”” border_width=”1px” size=”large” stretch=”default” shape=”round” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]PURCHASE YOUR SOLUTION[/fusion_button][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”20″ width=”200px” /][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no” element_content=””][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”#607d8b” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”” video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”20″ padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”rgba(96,125,139,0.54)” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

3-Year vs 5-Year Projections

[/fusion_text][fusion_text]

You may notice that many companies offer business plans with 3-year projections. Here at Backbone America, we provide 5-year financial projections. We do this for several reason. First, no one has more invested in your business than you. It’s the bulk of your time, energy, reputation, resources, and money that’s on the line. We provide 5-year projections to help you budget, give you a bit of peace of mind, and prepare for the future of your business.

Next, investors not only appreciate 5-year projections, sometimes investors require 5-year financials. Investing in a business is a long-term strategy. Investors realize it takes time for new businesses to gain momentum and pay off debt. Therefore, it’s important to investors to see your business has the potential to survive the long haul.

Though there are other reasons for using 5- vs 3-year financial projections. This final one mentioned has to do with taxes. 5-year financial projects are practical on an IRS level. In most cases, your business will need to show profitability 3 of the last 5 years to meet the IRS guidelines that you’re running a business, not a hobby. Your 5-year projections will give you an idea of the cash flow needed to satisfy the IRS 3 out of 5 year rule.

[/fusion_text][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”20″ width=”200px” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”yes” equal_height_columns=”yes” menu_anchor=”planningbonus” hide_on_mobile=”no” class=”fusion-menu” id=”” background_color=”” background_image=”” background_position=”right center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”0px” padding_right=”0px” padding_bottom=”0px” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#625d87″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

EVERY PACKAGE INCLUDES BONUS SERVICES

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#6797be” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”0″ animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Investor-Ready Audit

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

- Explore your current financial position

- Provide tips on obtaining funding

- Identify next steps

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#ceaa69″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”0″ animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Pre-Banking Session

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

- Ask the tough questions

- Provide tips

- Answer your banking questions

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#b6c387″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”0″ animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Post-Bank Follow Up

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

- Discuss your bank visit and next steps

- Make recommended changes to your written plan

- Cover best practices

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#625d87″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

BONUSES VALUED AT $897

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”#000000″ background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”” video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”20″ padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”0px 0px 25 0px” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

30-DAY, NO-HASSLE, MONEY-BACK GUARANTEE

[/fusion_text][fusion_button link=”http://themeforest.net/item/avada-responsive-multipurpose-theme/2833226?ref=ThemeFusion” title=”” target=”_blank” alignment=”center” modal=”pricingmodal” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”custom” button_gradient_top_color=”rgba(255,255,255,0)” button_gradient_bottom_color=”rgba(255,255,255,0)” button_gradient_top_color_hover=”rgba(255,255,255,.1)” button_gradient_bottom_color_hover=”rgba(255,255,255,.1)” accent_color=”rgba(255,255,255,.8)” accent_hover_color=”#ffffff” type=”flat” bevel_color=”” border_width=”1px” size=”large” stretch=”default” shape=”round” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]PURCHASE YOUR SOLUTION[/fusion_button][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”businessoptions” hide_on_mobile=”no” class=”fusion-menu” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”40px” padding_right=”” padding_bottom=”55px” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

Choose the option that’s right for your business

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”65″ sep_color=”#e0e0e0″ width=”200px” alignment=”center” /][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” min_height=””][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=”#1a80b6″]

Business Plan Review

[/fusion_title][fusion_imageframe image_id=”11209″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”center” lightbox=”center” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”fade” animation_direction=”up” animation_speed=”1.0″ animation_offset=””]https://backboneamerica.com/wp-content/uploads/2017/06/Business-Plan-Options-04-min.jpg[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”15″ bottom_margin=”15″ width=”200px” alignment=”center” /][fusion_text]

If you already have your business plan written, allow us to save you some money. We’ll throughly review your business plan. Our reviews include a markup of your document and recommendations to increase your chances of obtaining funding.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” min_height=””][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=”#1a80b6″]

Financial Pro Forma

[/fusion_title][fusion_imageframe image_id=”11208″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”center” lightbox=”center” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”fade” animation_direction=”up” animation_speed=”1.0″ animation_offset=””]https://backboneamerica.com/wp-content/uploads/2017/06/Business-Plan-Options-03-min.jpg[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”15″ bottom_margin=”15″ width=”200px” alignment=”center” /][fusion_text]

Are you great at words but rather not deal with the numbers? Financial projections are our speciality. We’ll interview you to identify the numbers we need. Then, we put together financial projections that meet bank and investor standards.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” min_height=””][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=”#1a80b6″]

Business Plan

[/fusion_title][fusion_imageframe image_id=”11210″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”center” lightbox=”center” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”fade” animation_direction=”up” animation_speed=”1.0″ animation_offset=””]https://backboneamerica.com/wp-content/uploads/2017/06/Business-Plan-Options-02-min.jpg[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”15″ bottom_margin=”15″ width=”200px” alignment=”center” /][fusion_text]

This is a great option if you already know where you’ll apply for lending, investors, or grants. If your funders request a business plan, this is exactly what you need. We work closely with you to create your complete business plan.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” min_height=””][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=”#1a80b6″]

Premium Business Plan

[/fusion_title][fusion_imageframe image_id=”11207″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”center” lightbox=”center” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”fade” animation_direction=”up” animation_speed=”1.0″ animation_offset=””]https://backboneamerica.com/wp-content/uploads/2017/06/Business-Plan-Options-01-min.jpg[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”15″ bottom_margin=”15″ width=”200px” alignment=”center” /][fusion_text]

If you’ve never run a business or don’t know where to go for funding, we highly recommend our premium package. Not only do we create your business plan, but we also do extensive research to find funding opportunities that are easy to miss.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”no” class=”” id=”” background_color=”#03a9f4″ background_image=”https://backboneamerica.com/wp-content/uploads/2017/06/graphicstock-multiethnic-group-of-young-business-people-creating-business-plan-in-office_r_zMgHXrnx-2-copy-copy-min.png” background_position=”center top” background_repeat=”no-repeat” fade=”no” background_parallax=”up” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”100px” padding_right=”” padding_bottom=”100px” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_imageframe image_id=”” style_type=”none” stylecolor=”” hover_type=”none” bordersize=”0px” bordercolor=”” borderradius=”0″ align=”center” lightbox=”center” gallery_id=”” lightbox_image=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”no” class=”” id=”” animation_type=”fade” animation_direction=”up” animation_speed=”1.0″ animation_offset=”” /][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all”][fusion_text]

We’re Here To Help Your Business Get Funded!

Work with a knowledge business advisor who can deliver what investors want to see

[/fusion_text][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” admin_toggled=”no”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” last=”no” hover_type=”none” link=”” border_position=”all” element_content=””][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”businessplanprice” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”fusion-menu” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_4″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_pricing_table type=”1″ backgroundcolor=”” bordercolor=”#494949″ dividercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” columns=”1″][fusion_pricing_column title=”Business Plan Review

($1,896 Value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”999″ time=”Investment” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]Business Plan Review[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286099″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][/fusion_pricing_table][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_pricing_table type=”1″ backgroundcolor=”” bordercolor=”#000000″ dividercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” columns=”1″][fusion_pricing_column title=”Financial Pro Forma

($2,296 value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”1,399″ time=”Investment” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]5-Year Financial Pro Forma[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286102″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][/fusion_pricing_table][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_pricing_table type=”1″ backgroundcolor=”#dbdbdb” bordercolor=”” dividercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” columns=”1″][fusion_pricing_column title=”Investor-Ready Business Plan

($4,896 value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”3,999″ time=”Investment” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]5-Year Financial Pro Forma[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286093″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order (Pay-in-Full)[/fusion_button]

Installment Plan Available

$1,500 Deposit +

3 Milestone Payments of $1,000

[fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286096″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Installment Plan[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][/fusion_pricing_table][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_pricing_table type=”1″ backgroundcolor=”” bordercolor=”” dividercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” columns=”1″][fusion_pricing_column title=”Premium Investor-Ready Business Plan

($8,094 value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”5,999″ time=”Investment” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]5-Year Financial Pro Forma[/fusion_pricing_row][fusion_pricing_row]*Funding Research[/fusion_pricing_row][fusion_pricing_row]**Growth Potential Package[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286111″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order (Pay-in-full)[/fusion_button]

Installment Plan Available

$2,000 Deposit +

4 Milestone Payments of $1,200

[fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286105″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Installment Plan[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][/fusion_pricing_table][fusion_separator style_type=”none” top_margin=”9″ bottom_margin=”9″ /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”premiumplan” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”fusion-menu” id=”” background_color=”” background_image=”https://backboneamerica.com/wp-content/uploads/2017/06/beautiful-african-american-young-businesswoman-with-cup-of-coffee-holding-clipboard-and-reading-in-office.jpg” background_position=”right center” background_repeat=”no-repeat” fade=”no” background_parallax=”right” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”rgba(96,125,139,0.54)” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

*Funding Research

[/fusion_text][fusion_text]If you’ve been turned down by traditional bank lending, the next step isn’t to throw in the towel. Bank lending isn’t your the option, and often times it isn’t necessarily the best option. The money is out there. The key is knowing where to find it.

That’s where we come in. We know where to look and have helped our clients infuse over $1.18 Millions in capital into their business. You could be our next success story.

We will search for funding sources (both grants and loans) at the local, city, state, and regional level. With your permission, we’ll also work with the various funding agencies to help increase your chances of approval.

This service comes with the Premium Business Plan and is Valued at $2,299[/fusion_text][fusion_button link=”” title=”” target=”_blank” link_attributes=”” alignment=”center” modal=”pricingmodal” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”custom” button_gradient_top_color=”rgba(255,255,255,0)” button_gradient_bottom_color=”rgba(255,255,255,0)” button_gradient_top_color_hover=”rgba(255,255,255,.1)” button_gradient_bottom_color_hover=”rgba(255,255,255,.1)” accent_color=”rgba(255,255,255,.8)” accent_hover_color=”#ffffff” type=”flat” bevel_color=”” border_width=”1px” size=”large” stretch=”default” shape=”round” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=””]PURCHASE YOUR PREMIUM BUSINESS PLAN[/fusion_button][fusion_separator style_type=”none” top_margin=”5″ bottom_margin=”20″ width=”200px” /][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”yes” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”30px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no” element_content=””][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”yes” equal_height_columns=”yes” menu_anchor=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”right center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”0px” padding_right=”0px” padding_bottom=”0px” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#ffffff” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no” element_content=””][fusion_text]

Growth Potential Package

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#625d87″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”10% 10% 10% 10%” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

**GROWTH POTENTIAL PACKAGE

[/fusion_text][fusion_text]The growth potential package includes four reports.

- Industry Matrix

- Performance Scorecard

- Profitability Report

- Growth Potential Report

Individually, these reports would cost $299 or $899 for all four. It’s included in the Premium Business Plan at no extra cost.[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ spacing=”” center_content=”yes” hover_type=”none” link=”” min_height=”none” hide_on_mobile=”no” class=”” id=”” background_color=”#ffffff” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no” element_content=””][fusion_code][/fusion_code][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#6797be” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Industry Matrix

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

View annual financials, median statistics, chart ratios, and more of your industry competitors or peer group as defined by your selected demographics

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#ceaa69″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Business Scorecard

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

Review a snapshot of your company’s financial state – liquidity, profitability, asset efficiency, and growth – compared to industry peers.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_3″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#b6c387″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Profitability Report

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

Evaluate your profitability performance using a primary measure of the earning power, Return on Asset Investment, and determine how to best increase sales and/or decrease expenses

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_4″ layout=”1_4″ spacing=”no” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”no” class=”” id=”” background_color=”#bf8397″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”10% 13% 8% 13%” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”down” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text]

Growth Potential

[/fusion_text][fusion_separator style_type=”single solid” top_margin=”5″ bottom_margin=”20″ sep_color=”#ffffff” width=”200px” /][fusion_text]

Determine how fast your company can grow given your capitalization structure and financial performance compared to industry peers using revealing measures of Sustainable Growth rate and examine was to improve growth potential

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”pricingmodal” title=”Packages” size=”large” background=”” border_color=”” show_footer=”yes” class=”” id=””]

[fusion_pricing_table type=”1″ backgroundcolor=”” bordercolor=”” dividercolor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” columns=”4″][fusion_pricing_column title=”Business Plan Review

($1,896 Value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”999″ time=”” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]Business Plan Review[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286099″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][fusion_pricing_column title=”Financial Pro Forma

($2,296 value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”1,399″ time=”” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]5-Year Financial Pro Forma[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286102″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order[/fusion_button][/fusion_pricing_footer][/fusion_pricing_column][fusion_pricing_column title=”Investor-Ready Business Plan

($4,896 value)” standout=”no”][fusion_pricing_price currency=”$” currency_position=”left” price=”3,999″ time=”” ][/fusion_pricing_price][fusion_pricing_row]Investor-Ready Audit[/fusion_pricing_row][fusion_pricing_row]Pre-Bank Session[/fusion_pricing_row][fusion_pricing_row]Post-Bank Follow Up[/fusion_pricing_row][fusion_pricing_row]5-Year Financial Pro Forma[/fusion_pricing_row][fusion_pricing_row]30-Day Money Back Guarantee[/fusion_pricing_row][fusion_pricing_footer][fusion_button link=”https://app.acuityscheduling.com/catalog.php?owner=12633607&action=addCart&id=286093″ title=”” target=”_blank” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Order (Pay-in-Full)[/fusion_button]

Installment Plan Available

$1,500 Deposit +

3 Milestone Payments of $1,000