IndustriusCFO Software Review: Financial Analysis Software

![]() IndustriusCFO happened upon my radar when I was at an American Small Business Development Center (ASBDC) conference. I never took the opportunity to explore this financial analysis software until I decided to venture on my own with Backbone America. I have to admit, I’m rather impressed with what this product can do.

IndustriusCFO happened upon my radar when I was at an American Small Business Development Center (ASBDC) conference. I never took the opportunity to explore this financial analysis software until I decided to venture on my own with Backbone America. I have to admit, I’m rather impressed with what this product can do.

Company Overview

IndustriusCFO is a Wisconsin based company, previously known as Fintel. A little about Fintel before going into IndustriusCFO, as Fintel’s history says a lot about the current software. Prior to Fintel’s formation in 2000, researchers at the University of Wisconsin were tasked analyze the largest proprietary database, which was populated with financial information from US companies. The efforts resulted in benchmarking and other financial tools. IndustriusCFO builds upon Fintel’s original features to create a software that’s user friendly.

Reporting Tools

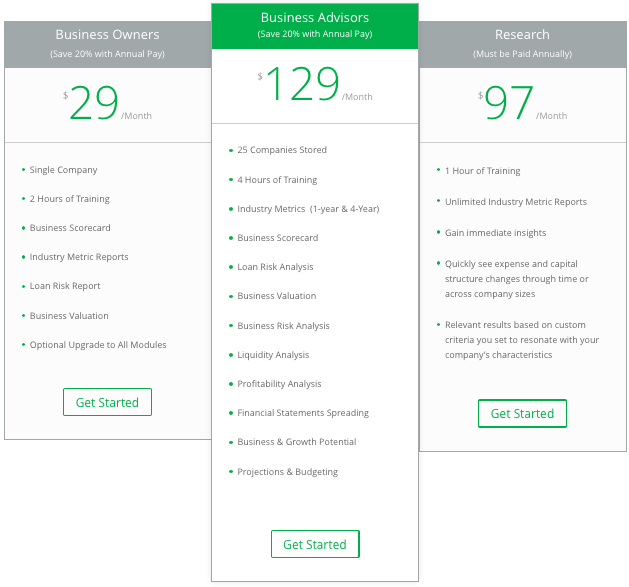

IndustriusCFO comes with a host of reporting tools. Each report is measured against industry data, which can be narrowed down by region (states, county, cities), net sales, total assets, company age, and other filters. One item I would have liked to have seen is the employee count in the metrics. The software does ask for the number of employees and uses it in calculations, such as revenue per employee. However, the reports don’t indicate an average or anything like that when it comes to the number of employees. All of the reports are available for viewing online or downloadable as a PDF file. The main tools available at the Business Owner level focuses on the health of the company.

IndustriusCFO comes with a host of reporting tools. Each report is measured against industry data, which can be narrowed down by region (states, county, cities), net sales, total assets, company age, and other filters. One item I would have liked to have seen is the employee count in the metrics. The software does ask for the number of employees and uses it in calculations, such as revenue per employee. However, the reports don’t indicate an average or anything like that when it comes to the number of employees. All of the reports are available for viewing online or downloadable as a PDF file. The main tools available at the Business Owner level focuses on the health of the company.

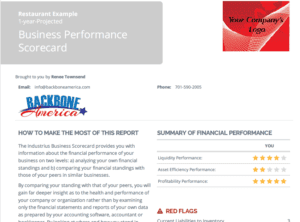

I consider the Business Performance Scorecard to be one of the core reports. It compares your company’s financial data against other companies in your industry and looks at key performance indicators (KPIs): cash availability, effective asset management, and profitability. This report also identifies red flags, which can provide direction in fixing troublesome areas of your company.

The Business Owner level also comes with a couple of other reports. The Loan Risk report gives a prediction of the success the business will have in repaying the loan and also a suggested interest rate for the loan. The Business Valuation gives an idea of what the business is worth, using a few recognized valuation techniques.

Industry Metrics

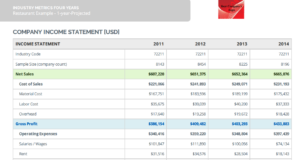

Industry Metrics reports come in 1-year and 4-year versions. It’s great for companies that already have financial tools, but need industry data for a deeper analysis. The Industry Metrics reports provide the averages for the Income Statement and Balance Sheet. The main difference between the two versions is the 1-year reports provides averages for small, medium, large, as well as an aggregated average, while the 4-year provides an aggregated average for most recent years, broken down by each year.

Industry Metrics reports come in 1-year and 4-year versions. It’s great for companies that already have financial tools, but need industry data for a deeper analysis. The Industry Metrics reports provide the averages for the Income Statement and Balance Sheet. The main difference between the two versions is the 1-year reports provides averages for small, medium, large, as well as an aggregated average, while the 4-year provides an aggregated average for most recent years, broken down by each year.

Similar to the Industry Metrics is a Compare and Spread Report, which includes a side-by-side comparisons of your company’s income statement, balance sheet, and financial ratios against industry standards. I found the Compare and Spread reports to be very similar to the Business Performance Scorecard, but does not identify red flags.

Financial Scenarios

The scenario tools are available in the Business Advisor package, but can be added onto the Business Owner level. From what I’m told, IndustriusCFO will be changing the Business Owner plan to include all the features in the Business Advisor level, but with greater limitations to the number of businesses and industry reports you’re able to create. So, keep your eyes out for changes in the plans.

The scenario tools are available in the Business Advisor package, but can be added onto the Business Owner level. From what I’m told, IndustriusCFO will be changing the Business Owner plan to include all the features in the Business Advisor level, but with greater limitations to the number of businesses and industry reports you’re able to create. So, keep your eyes out for changes in the plans.

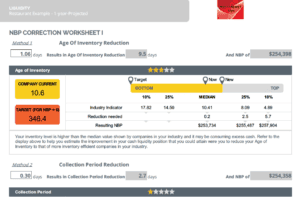

These tools allow you to create what-if scenarios for Liquidity, Profitability, and Growth Potential. Like the other reports, it includes industry data that is useful for determining where there’s room for improvement. Take for example that your business collection period is 13 days, but the industry standard is 3 days. IndustriusCFO would show you how liquid your business would be if you were to decrease your business collection period by 2 days or however many days you’d like to meet.

Customer Service

IndustriusCFO truly wants you to be successful with its software. As part of my trial, I received one-on-one training on the product. The first training session was an overview of the software, such as how to input data and run the reports. After I used the software for about a week, I had a couple of Q&A sessions. All my training sessions were done through GoToMeeting, which was helpful with the walkthroughs.

Ease of Use

IndustriusCFO allows users to manually input data or import data from accounting software programs or spreadsheets. Once the data is in the system, running the reports is a matter of a few clicks.

IndustriusCFO allows users to manually input data or import data from accounting software programs or spreadsheets. Once the data is in the system, running the reports is a matter of a few clicks.

I have mixed feelings in terms of the ease of use, mostly because the way my financial data is organized. I use an excel workbook for my projections, which is organized monthly for each year. Though IndustriusCFO accepts data for any period (monthly, quarterly, annually, bi-annually, etc.), it needs to be in summary form, rather than detailed. As such, I manually inputted my data. Manual entry wasn’t difficult, just not as convenient as I would have liked.

If you use typical accounting software, such as QuickBooks, FreshBooks, or Xero, importing your data shouldn’t be a problem. Likewise, if I’d taken the time to summarize my data in a compatible format, I could also successful import my data, which I may do in the future.

Final Thoughts

As I was exploring IndustriusCFO, it often reminded me of a program called Profit Mastery, which is a teaching program that helps entrepreneurs become financially more efficient. Profit Mastery is about 16 hours of video training that makes me think of the quote “teach a man to fish and you feed him for a lifetime.” Personally, I think Profit Mastery is a great program that teaches you how to analyze your data, using mathematical formulas and pinpoint areas for improvement.

IndustriusCFO does the work for you. Rather than doing your own calculations, IndustriusCFO does the number crunching. Rather than looking for the gaps that are keeping your business from being more efficient, IndustriusCFO finds them for you.

Overall, I quite enjoyed my experience with IndustriusCFO, enough to adopt it for my business.

Pricing