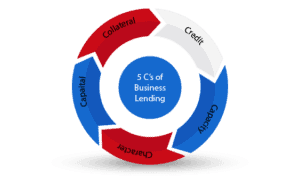

Capital requirements vary by the type of business loan you want to obtain. It refers to the equity percentage you’re required to invest in your venture. It’s also one of the 5 key elements investors consider when approving or denying your small business loan.

The bottom line is that you need to have some “skin in the game,” ie, capital. Small business lending is pretty risky. Lenders know that when it push comes to shove, that when you’re short on cash, the business loan is one of the last items to get paid. That’s why they want you to be invested and have something at risk also. Lenders use capital requirements to help ensure you won’t just throw in the towel when things get tough.

Capital Requirements for Bank Lending

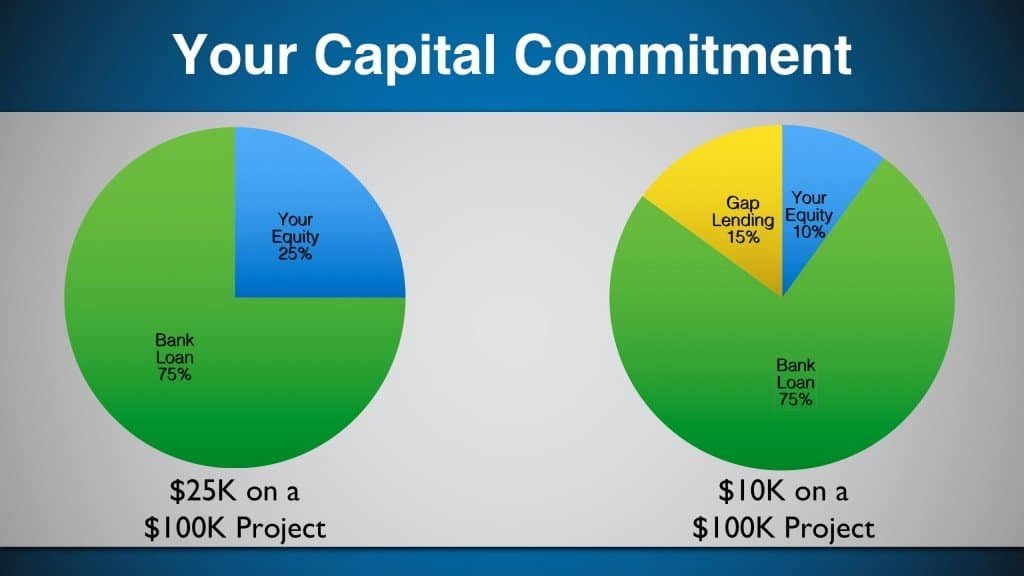

Unless you’re going to grandma for a loan, you’re going to find lending programs where your project is 100% funded by someone else. You’ll need to put up something yourself. The capital requirement for most bank loans is about 25%. This means if your project is $100K, the bank expects you to come up with about $25K.

Here’s the thing though. That 25% doesn’t have to come entirely from your coffers. Depending on your state, city, or locality, some of those funds can be offset by gap lending programs. Even so, those gap lending programs still want you to contribute some capital. However, those capital requirements may be as low as 10%.

Using that same $100K project, instead of coming up with $25K, you may only need to come up with $10K. That’s a huge difference. Getting access to those additional dollars is how you leverage your money.

Capital Requirements for Grants (Bonus)

Though this article is mostly about lending, your capital can also be used for grants. Grants are interesting creatures. When many think of grants, it seems like there’s no risks involved. For example, a Pell grant is free money for education. You aren’t required to put forth any money to receive the grant. You simply attend school and meet your commitments. Business grants aren’t like that.

Just like small business lending, business grants also have capital requirements. These capital requirements are typically labeled as matches. For example, you might have a 3:1 or 4:1 match. A 3:1 match might look like this. You pledge $20,000 to your project and receive $60,000 in grant funds.

The great thing about grants is that as long as you follow the rules and regulations governing them, they never have to be repaid. Business grants are often hard to come by. However, if you’re in a specific industry like agriculture or technology, you may find you have an easier time that other types of businesses. Also, looking for grants that cover specific needs in your business, like marketing or green equipment, may be an easier sell than a grant to cover general business needs.

Final Thoughts

Isn’t that so true. If you are looking to start a business, or even expand your current business. Now is the time to prepare. Start getting your financials in place so you can be ready for the opportunities when they come. What does that mean? If you have the capital, great… You’ve knocked out a crucial step to getting your business funded.

If you don’t have the capital equity, that’s fine too. Now is the time to start putting away the capital and implementing ways to build your nest egg, so you can take advantage of opportunities as they arise. How are you going to do that? By committing to an equity goal and putting money away.

I see so many people miss out on opportunities simply because they didn’t plan ahead. So, prepare and be ready.