Small business owners faced unprecedented economic uncertainty in the wake of the global pandemic. Many businesses closed. Even I was bummed to see my favorite gluten-free bakery close. Many others reduced services. For them, fewer offerings can lead to financial hardship and difficult decisions when trying to stay afloat. Then there are natural disasters. Every other day I see to hear about a tornado, fire, or hurricane destroying a cities and towns. Fortunately, there is help available in the form of a small business interruption loan that can provide much-needed liquidity during trying times.

What is a Small Business Interruption Loan?

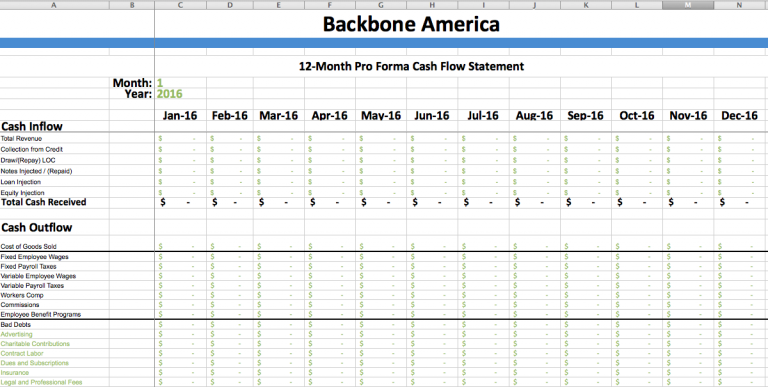

A small business interruption loan is a type of short-term loan designed specifically for businesses affected by unexpected events. Pandemics like COVID-19 and natural disasters fall into that category. These loans offer quick access to capital. This allows businesses to continue operating while they wait for more permanent sources of funding, such as government grants or investor financing. The loan amounts typically range from $5,000 up to $2 million depending on the size and nature of your business. Meanwhile, repayment terms ranging from 3 months up to 5 years.

Where Can I Find a Small Business Interruption Loan?

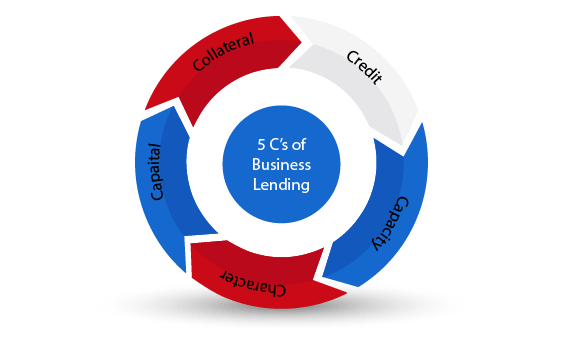

What Should I Consider Before Applying For A Small Business Interruption Loan?

Make sure you understand all associated fees, including origination fees, closing costs, prepayment penalties etc. This will help you evaluate the different loans. You may even find it opens up opportunities to negotiate the terms. Additionally, read through all documentation carefully before signing any binding agreement between yourself and lender/banker/investor etc. Lastly, remember no matter what type finance route you choose, make sure its best fit your business long term goals.

In Conclusion

Some small business owners have faced tremendous challenges over the past few years. And as always, the future is always uncertain. If you happen to find yourself in where you’re effected by an unexpected event, don’t lose heart. Thankfully there are solutions available, such as small business interruption loans. These loans can give some breathing room, while figuring out the next steps moving forward. With careful consideration and evaluation, it’s possible to find viable options while ensuring the current and future health of your business.