As the world becomes increasingly interconnected and digital, I believe the opportunity to launch a small business startup has never been better. The thing is, starting a business from scratch can be a challenging. It has many pitfalls (avoidable, of course) and important steps you don’t want to overlook. In this article, I’ll outline five key steps to launching your Small Business Startup and setting it up for success.

Step 1. Conduct Market Research

Market Research Overview

A quick overview of what market research is. It refers to gathering and analyzing information about a particular market or industry. For this, you’ll need to collect and interpret data related to consumer behavior, preferences, and trends. This will help you make make informed decisions about product development, pricing, promotion, and distribution.

I think a common missed step in all this is identifying potential customers. I’ve asked clients in the past who’s their target customer, and they’ve said “everyone.” That is so not true. As much as you’d like to believe, everyone is not interested nor has the desire to use your products or services. Otherwise there would be no apple vs android or Google vs Bing or Facebook vs YouTube. I can go on and on, but I’m sure you get the idea.

That’s why one of the primary goals of market research is to narrow down your ideal customer, then understand their needs and preferences. By doing so, you’ll be able to develop marketing strategies that are tailored to your target market and increase the likelihood of success for your business. Plus, conducting market research will help your business gain a competitive advantage by identifying gaps in the market and offering products or services that meet the needs of your customers.

Market Research Methods

There are several methods of conducting market research. This can include surveys, focus groups, and data analysis. Surveys involve collecting data from a large sample of individuals through questionnaires, online forms, or telephone interviews. Focus groups are small, moderated discussions with a specific target audience to gather feedback on a product or service. Data analysis involves analyzing existing data, such as sales reports and customer feedback, to identify trends and patterns.

Market research can be both qualitative and quantitative. Qualitative research involves gathering information about consumer attitudes, opinions, and motivations through open-ended questions and discussion. Quantitative research, on the other hand, involves the collection of numerical data, such as sales figures, that can be analyzed using statistical methods. Keep in mind, you can combine use both qualitative and quantitative data in your analysis. Likewise, you can use multiple methods of research to get a bigger and/or more detailed picture of your target customers.

Market research extend beyond just understanding the needs and preferences of customers. By conducting research, your business can also gain insights into your competitors, including their strengths and weaknesses, pricing strategies, and market share. By investing in market research, your business can make informed decisions that lead to long-term success.

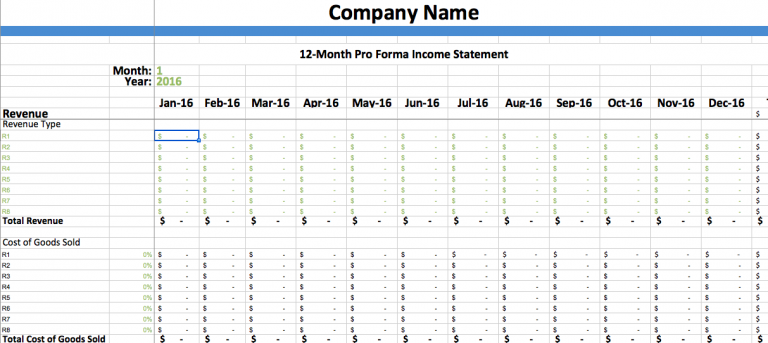

Step 2. Develop a Business Plan

Your business plan is a roadmap to your company’s success. It involves setting goals and objectives, identifying resources, and creating strategies to achieve those goals. A well-crafted business plan can help business owners stay focused on their objectives and make informed decisions about future growth.

Business Plan Benefits

One of the key benefits of business planning is that it helps business owners identify their target market. I know I mentioned market research earlier. However, a business plan isn’t complete without your market research. In fact, your market research may even help you decide if it’s the right type of business to start long before you get to including the research into your business plan.

Another benefit of business planning is that it allows businesses to identify potential obstacles. Once identified, you’ll be able to develop strategies to overcome them. This may involve developing contingency plans for unexpected events or identifying ways to reduce costs and increase efficiency. I’ve worked in companies where conducting business is reactionary. Trust me, this is not the way you want to run your business, as it decreases your chances of success. By anticipating potential challenges and developing solutions in advance, your business can minimize the impact of those challenges and stay on track toward achieving your goals.

Business planning can also help businesses secure funding from investors or lenders. A well-crafted business plan provides potential investors with a clear understanding of the company’s goals, strategies, and financial projections. This information can help investors make informed decisions about whether to invest in your company.

Finally, don’t forget to revisit your business plan. Your business planning help you stay focused on your objectives. It’ll also help you make make informed decisions about future growth. By regularly reviewing and updating your business plan, you can adapt to changing market conditions and identify opportunities for growth and expansion.

Step 3. Secure Funding

Securing funding is a crucial aspect of starting and growing a small business. However, for many small business owners, finding the right funding can be a challenging task. Here are some strategies for securing small business funding:

- Explore traditional financing options: Small business owners can explore traditional financing options, such as loans from banks and credit unions. As a startup company, banks will likely base their decision on your personal finances, as well as your business plan. To increase your chances of securing a loan, you should have a solid business plan, a good credit score, and collateral to offer as security.

- Consider alternative financing options: In addition to traditional financing options, you might also consider alternative financing options. Some alternative methods include crowdfunding, venture capital, or angel investors. Crowdfunding involves raising money from a large number of people. Often times, the individuals willing to invest in your product or service receive something in the future as compensation. One popular place for crowdfunding is Kickstarter. On the other hand, venture capital and angel investors involve finding investors who are willing to invest in the business in exchange for equity. You may have seen examples of this on TV series such as Shark Tank.

- Look for government-backed loans: One of my favorites, probably because I worked for a Small Business Development Center are government-backed loans. The U.S. Small Business Administration (SBA) offers several loan programs to help small business owners secure funding. These loans are backed by the government, which means that they are less risky for lenders and may have more favorable terms and interest rates. One such loan that I covered is the Small Business 8(a) program.

- Seek out grants: Typically a little harder to receive, but you can also look for grants. These funds do not need to be repaid. Grants are often offered by government agencies, nonprofit organizations, and private companies. However, grants can be highly competitive, and business owners should be prepared to submit a strong proposal.

Last but not least, try to build relationships with potential investors by attending networking events, pitching ideas to investors, and keeping in touch with them over time. Someone once told me that networking is about building relationships before you need them. The thing is, you never know when you’ll benefit from a bit of help. That’s why building strong relationships with investors can help you, as a small business owner, secure funding when they need it.

Step 4. Set Up Your Business Infrastructure

Setting up your small business infrastructure involves registering your business, obtaining necessary licenses and permits, and establishing a legal structure. Depending on your business’s location and industry, you may also need to hire employees, purchase equipment, and establish partnerships with suppliers. Your business infrastructure is a critical step in starting and growing your business. Let’s dig a bit into what those items are:

- Register Your Business: In most states, before you can start operating legally, you need to register your business. Beyond the legal requirements, it also helps establish your brand, and in some cases, protect your intellectual property. You can register your business with your state or local government, depending on your business’s location and legal structure. To get you started, I’ve provided a list of resources by state.

- Obtain Necessary Licenses and Permits: Depending on your business’s industry and location, you may also need to obtain specific licenses and permits. These may include zoning permit, health department permit, or a seller’s permit. You may find your type of business requires state and federal licenses or permits. Make sure to research and obtain all necessary licenses and permits before launching your business.

- Establish a Legal Structure: Choosing a legal structure for your business is an important decision that can impact your taxes, liability, and management structure. Common legal structures for small businesses include sole proprietorship, partnership, limited liability company (LLC), and corporation. I encourage every business owner to consult with a lawyer or accountant to determine the best legal structure for your business. When you register your business, you’ll need to have decided on a legal structure.

- Hire Employees: Depending on your business’s size and industry, you may need to hire employees. Additionally, if you plan to stop trading time for money, you’ll want a business model that’s scalable. This often involves having others help you run your business. Above all, make sure to comply with all labor laws and regulations, such as minimum wage laws and overtime rules.

- Purchase Equipment: You may also need to purchase equipment or tools to help you run your business. Make sure to research and compare prices to find the best deals on equipment and supplies. Also keep in mind that these costs may be considered startup costs. So, remember to keep track of those expenses. Your account can help you offset those costs and perhaps lower. your tax liabilities.

- Establish Partnerships with Suppliers: Establishing partnerships with suppliers can help you obtain the resources and materials you need to run your business efficiently. Like equipment, you’ll want to negotiate prices and terms to get the best deals. Like networking, you’ll want to establish long-term relationships with your suppliers.

Before I finish this section, I want to emphasize the importance of consulting with legal and financial experts to ensure compliance with laws and regulations and make informed decisions.

Step 5. Market Your Products or Services

Marketing Essentials

First up, is the need to develop a marketing plan. This is where you’ll put your market research to work. A marketing plan outlines your strategies for promoting your products or services. It should include your target audience, marketing channels, budget, and metrics for measuring success.

Next, you’ll want to create a website. In this digital age, not having a website can put you at a severe disadvantage. In fact, a website is a crucial component of your digital marketing strategy. It serves as a hub for your brand, providing information about your products or services, contact details, and other relevant information. Make sure your website is user-friendly, mobile-responsive, and optimized for search engines.

You’ll also want to establish a social media presence. Social media platforms such as Facebook, Instagram, and Twitter are powerful tools for promoting your brand and engaging with customers. Develop a social media strategy that aligns with your marketing plan and post relevant content regularly. Sometimes it’s helpful to outsource your social media marketing. However, you’ll want to be sure the individual(s) you hire understands your brand.

Finally, be sure to build relationships with customers and clients. Your relationship with customers and clients affects trust and loyalty. You can do this by responding promptly to customer inquiries and feedback, offer personalized services, and rewarding loyal customers with discounts and special offers.

When it comes to marketing, it’s a hands on approach. You don’t simply set it and forget it. Remember to monitoring and analyzing your marketing results. It’s essential for determining the effectiveness of your strategies and making informed decisions. Use tools such as Google Analytics to track website traffic, social media metrics, and other relevant data. Above all, remember to stay flexible, adapt to changes in the market, and constantly refine your strategies to stay ahead of the competition.

Launch Your Business

Once you’ve laid the foundations, it’s time to launch your small business startup. Launching a Small Business Startup requires careful planning, research, and execution. By following these five key steps, you can set your business up for success and achieve your business goals. Remember to stay flexible, adaptable, and open to new ideas and opportunities as your business grows and evolves. Good luck on your small business startup journey!