Understanding How Small Business Loans Work

Starting or expanding a small business often requires financial support, and small business loans can be…

Starting or expanding a small business often requires financial support, and small business loans can be…

Small business owners faced unprecedented economic uncertainty in the wake of the global pandemic. Many businesses…

One of the highlights of being a small business advisor was finding funds for my clients….

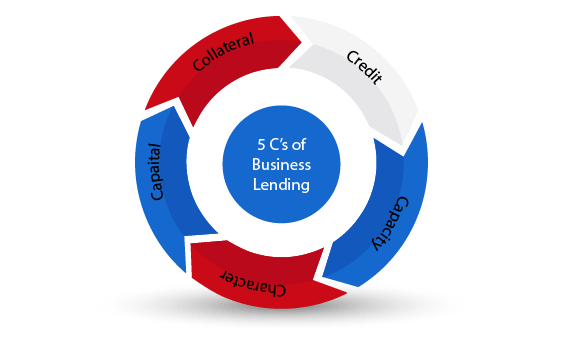

If you’re seeking a business loan, it’s guaranteed that lenders will look at your credit score…

In a previous post, capital requirements for lending were covered. The next area investors look at…

Financial stability is a major concern for new business owners. Not only do new companies require…

Capital requirements vary by the type of business loan you want to obtain. It refers to…

A lot of start-ups and new businesses fold as a result of insufficient capital. Much of…

Guaranteed Business Loans: Government Programs I’m a big fan of guaranteed business loans. Sometimes it requires…

Is a Bad Credit Business Loan Worth Pursuing? Ruining your credit is quite easy these days….