One of the highlights of being a small business advisor was finding funds for my clients. As I’ve mentioned before, I told my clients if they came up with 10%, I’d do my best to find the rest. Most of it came in the form of loans. However, it always excited me to find grants. I was very familiar with grants in Nevada, where I practiced as a SBDC Business Advisor. That was then. Now my focus turns to Nevada Small Business Grants.

The state of Nevada offers a wide range of grant and loan programs designed to support small businesses throughout the state. From start-ups to existing companies, these financial assistance packages can provide essential capital needed to grow or maintain operations. When looking for grants, loans, and incentives try government entities, economic developers, nonprofits, and community development financial institutions (CDFIs).

Nevada Small Business Grants

The first thing to keep in mind when it comes to grants is they’re usually focused on a very specific need. For example, they may be for helping you with employees, enhancing agriculture, or making a physical local more affordable. If you’re looking for ways to secure additional funds for your business, here are some great options available through Nevada small business grants.

It wasn’t until I moved to Nevada that I realized that non-profits were entrepreneurial opportunities also. Places like Nevada’s Women’s Philanthropy offers two types of grants to non-profits. Impact Grant is the name of one and the other is the Founders Gift.

When I lived in North Dakota, I heard of this term, “Small Town Sexy.” All of North Dakota is rural. Small Town Sexy to me is a way to show the allure of living in a rural community. For those who are interested in the rural life, I’ve found the best grants at that level. Take for instance the Rural Business Development Grants in Nevada program offered by USDA Rural Development has not maximum amount it’ll provide.

Nevada Small Business Incentives

Nevada also has several tax incentive programs. These programs are designed to attract new investment into areas where unemployment rates are high or economic development goals are being met by certain industries, like agribusinesses or energy providers. This could mean big savings come tax season, depending on what sector the business operates within. As always, it’s important to check local regulations. Here are some examples.

Nevada’s Governor’s Office of Economic Development offers several incentives for entrepreneurs who want to start busin

- The Standard Abatement Program provides a partial abatement of property taxes for businesses located within designated tax incentive areas.

- The Data Center Abatement Program offers an exemption from sales and use taxes on certain purchases related to the construction or operation of data centers in Nevada.

- The Aviation Parts Abatement program grants full or partial exemptions from state sales and use taxes on parts used to repair, maintain, and overhaul aircraft in Nevada.

All three programs are designed to encourage investment in the state by providing incentives for businesses that create jobs and stimulate economic activity.

Also check out incentives offered by the cities in Nevada. For example, Las Vegas Economic Development offers rebates for key infrastructure costs with its Tax Increment Financing (TIF) program. It also has a New Market Tax Credit that focuses helping entrepreneurs with owner-occupied commercial real estate projects.

Nevada Small Business Loans

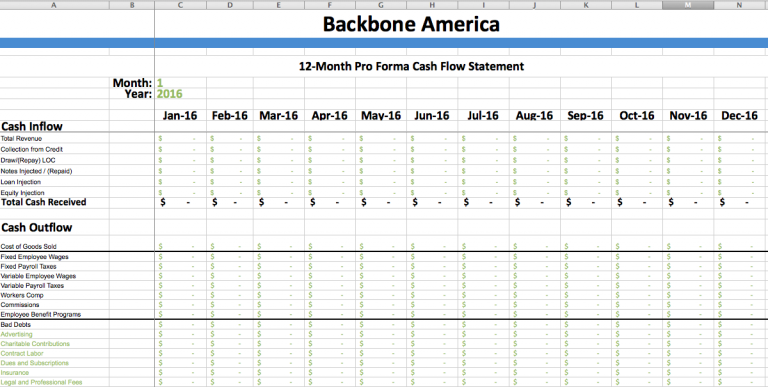

Not as attractive as grants and incentives, but loans are also an option for funding. The great thing I’ve found about small business loans offered by non-commercial banks is that the terms are usually more favorable than a personal loan. However, they’re not always the easiest to obtain. The most important piece I’ve found with obtaining business loans is having a sound business plan with financials that work. Having someone help you navigate the system doesn’t hurt either.

Conclusion

Finding success doesn’t come easy, especially when finances are tight. Thankfully there are several viable opportunities through Nevada small business grants for those ready to take advantage. Whether its jumpstarting an idea from scratch or working on growth and sustainability, an injection of cash can be helpful. So be sure to take advantage of all the grants, incentives and loans available in Nevada.