Guaranteed Business Loans: Government Programs

I’m a big fan of guaranteed business loans. Sometimes it requires entrepreneurs to jump through a few hoops. However, it can be the deciding factor in receiving a “Yes!” from a lender or a denial letter. For my clients who could use the extra boost, I certainly look into it for them.

What is a Guaranteed Business Loans?

In the US, most guaranteed business loans are government sponsored, though you may be able to get a relative to guarantee a business loan or you. For now, let’s talk about some of the more popular government guarantees.

Small Business Administration (SBA)

I tend to talk a lot about the SBA. It’s likely because my background is as an Small Business Development Center (SBDC) Business Advisor, which is a SBA program. The SBA is a federally funded program aimed at helping entrepreneurs start and grow their small businesses. It typically doesn’t provide any direct services itself. Rather it funds programs, such as SBDC offices and advisors to provide the services in its stead.

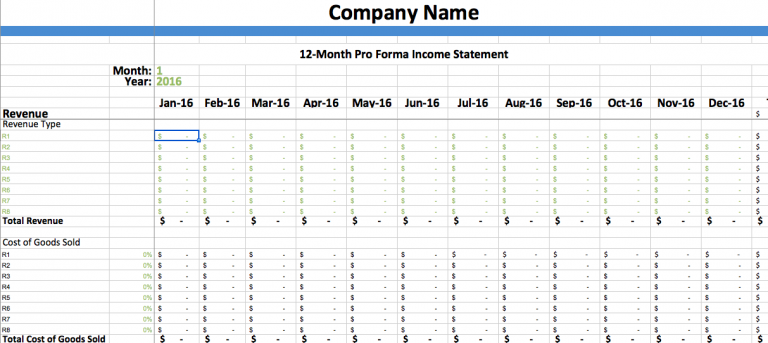

The SBA partners with banks and select alternative lenders to offer Loan Guarantees to entrepreneurs starting or expanding their businesses. What’s nice about the program is there’s no minimum amount they’ll guarantee and they’ll guarantee a loan up to $5 million. There Loan Guarantee Program will guaranty 75-85% of a loan, depending on the size. That’s pretty sweet.

VA Loan

A lot of veterans are familiar with the VA Loans for mortgages. The VA also provides a variety business programs for veteran entrepreneurs. A key difference with VA Loans versus other loans is eligible veterans can often borrow with lower fees and even no fees, which can save thousands of dollars.

U.S. Department of Agriculture (USDA)

The final type of guarantee I want to talk about is the USDA loans. When I lived in North Dakota, USDA loans were pretty attractive. The thing with USDA loans, is it’s not just for farmers and ranchers. The USDA also has an initiative to help rural areas. Because the USDA has two programs, which might interest you as entrepreneurs, I’ll break them down separately.

Farm Service Agency (FSA) Farm Loan Programs

USDA Rural Development – Business & Industry Loan Guarantees

As the name would suggest, the USDA Rural Development programs helped rural businesses. USDA Rural Development defines rural as cities or towns with populations less that 50,000. That was pretty much all of North Dakota. 🙂 The USDA is pretty generous with its Business & Industry Loan Guarantees It’ll work with loans up to $25 million and guarantees 60-80% of a loan, depending on its size. These programs can really make a small town attractive for starting a business.

Final Thoughts

Regardless of what we see on the political scene, there are still pieces of the government who understand the importance of small business and work to support it. Programs are out there to help you succeed. A guaranteed business loan may be one of those answers for you. As always, I encourage you to research your options and tap into opportunities that increase your chances of success.

Getting access to financing is a real challenge to small, micro and medium enterprises (SMMEs). With my background in export strategy development, I can fully attest to this critical cross-cutting issue that faces many economies, not just the US.

Speak to any economist and they will tell you that small businesses are the backbone of an economy. However, it is very surprising that the financial services sector do not fully support ‘the backbone’ of the economy. So guarantee loans are critical to solving this issue of lack of financing.

There are usually a lot of programs out there but sadly, many small businesses are not fully aware of what these programs are or how to access them.

Hopefully you website will help a few of them out.

Cheers

Kevon

This was a great read with a lot of great information. I had a little bit of info on the SBA loans but you really opened my eyes to reasons I should look more into it. This is a must-read for entrepreneurs and definitely something I will be sharing.

In Canada, the Government of Canada has set up a Small Business Financing Program. (http://www.ic.gc.ca/eic/site/csbfp-pfpec.nsf/eng/Home) that some people might be interested in looking into. I don’t know if these loans are Guaranteed Business Loans is loan program is available.

When searching around, I found that there are many different companies out there that will also help you go through the application process. A couple of months ago, I talked to a few of them and I have to say that something just didn’t sound right when I talked to a couple of them. When looking at these outside companies, just be cautious.

Cheers,

Peter