Financial Freedom Friday

Financial freedom vs financial independence isn’t just semantics. I’ve sat with both ideas—turned them over in my mind, asked myself which one I was chasing, and why. They’re often used interchangeably, but in my experience, they feel like completely different paths. And the one you’re on shapes more than just your bank balance. It shapes your business, your boundaries, and your beliefs about what’s possible.

When I was building Backbone America, I kept my day job. Not because I wasn’t serious—but because I was. I wanted my business to grow from a place of stability, not survival. I have family members who are financially independent—no job, no hustle, but not a lot of cushion either. They’re just getting by. And I’ve watched retirees in the same boat: some wondering if their check will stretch to the end of the month.

I’ve had moments when I thought, maybe that’s enough. Pay off my debt, live off savings and passive income, move somewhere cheaper, and just… exist. But I knew in my gut that wasn’t my dream. I didn’t just want affordability. I wanted freedom. Not to live extravagantly, but to live fully. To explore. To enjoy. And to have choices—and not just the cheapest ones.

That’s why, for me, this distinction matters. And maybe it’ll shift something for you too.

What is Financial Independence?

That model of independence is baked into a lot of our thinking. Work long enough, save consistently, and eventually you get to “not work” as a reward. And for a long time, that was held up as the pinnacle. But what I’ve learned—especially as someone building a business while still working—is that not working isn’t the same thing as being free.

Financial independence, as it’s traditionally defined, is static. You arrive. You stop. But what happens if you still want to build something? What if you want to be in motion, to create, to explore? What if you’re not ready to stop?

That’s where I started to realize that my goals didn’t quite align with the old-school blueprint. I wasn’t looking to unplug. I was looking to choose—what I do, when I do it, and how I make my money.

That’s not a knock on anyone who wants the more traditional path. If stepping out of the workforce and into a quiet, self-sustaining life is your dream, I respect that. It just wasn’t mine. And I think more of us need space to admit that.

So for me, financial independence is part of the picture, but not the whole thing. It’s a benchmark—something I’ll grow into. And every time I reduce debt, increase income, or gain more control over how I work, I’m inching closer.

You don’t have to “arrive” at independence to feel proud of where you are. Take the win. Take every win.

What About Financial Freedom

This is where the difference between financial freedom vs financial independence really takes shape for me. Independence is about not needing to work. But freedom? Freedom is about having room to choose how you work—and when, and for what purpose.

In the early days of Backbone America, that freedom felt far away. Not only was every dollar the business earned going right back into operations, but my paycheck was covering the rest—website fees, software, ad tests, contractors. I was funding it with intention, but also with sacrifice. It was tight.

I remember sitting with my mom, talking through whether I should dip into my savings. I wasn’t making a reckless decision. Carved out a small amount, I thought —just enough to give the business a nudge. I told her, “Even if this doesn’t take off the way I hope, I won’t regret spending this.” Because I needed the progress. I needed to know I gave it space to grow.

That decision didn’t make me financially independent. I was still working, still relying on benefits, still budgeting closely. But it did move me toward something more important: a sense of control. I wasn’t just reacting. I was making intentional choices about how to move forward.

That’s how I define financial freedom. It’s not about crossing some threshold where everything is “handled.” It’s the power to adjust, to pivot, to invest in your own ideas without fear that everything else will fall apart.

I’m not there yet—not completely. But Backbone America gives me options. And options are the beginning of freedom.

How This Distinction Changes the Way You Build

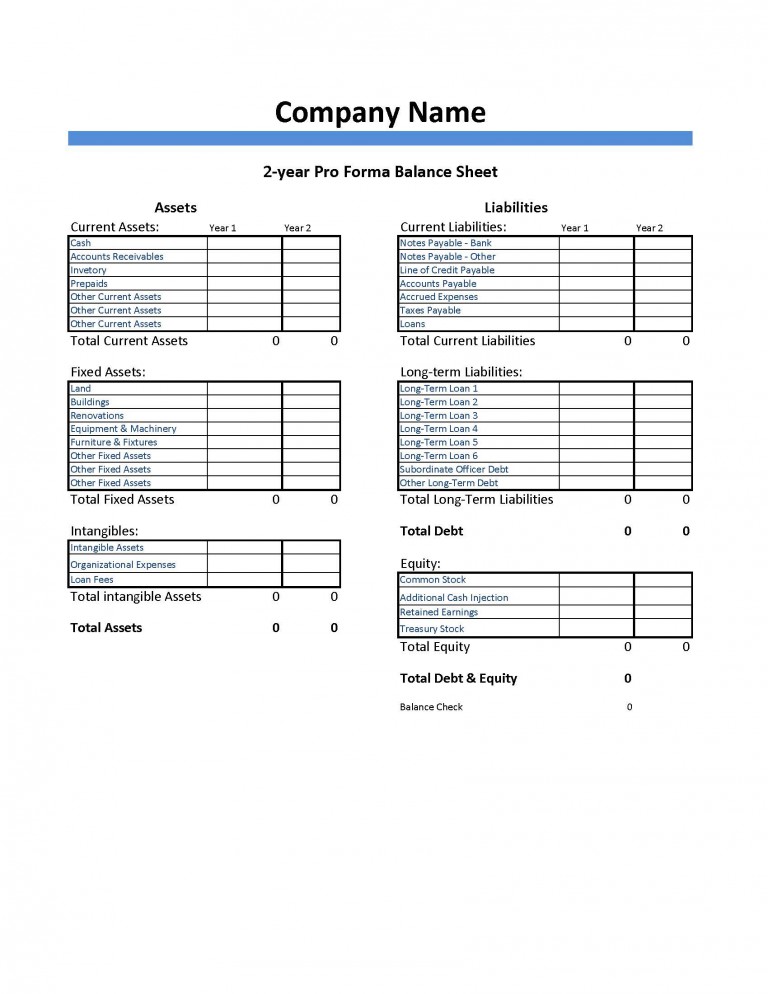

For me, financial independence is a milestone. But financial freedom is the dream. That clarity helps me make better decisions—especially when I’m mapping out pricing, launches, and long-term plans. When I create a new product or service, I’m not just thinking about whether it can sell. I think about how much it could generate monthly by the end of the year. I map out the cost to get there. The time it will take. The support I’ll need. Then I ask, “Is this worth pursuing right now?”

That kind of thinking only makes sense if you’re building with freedom in mind—where the goal isn’t just a profitable product, but a sustainable system that gives you more control over your time, energy, and outcomes.

It’s also why I’ve never seen my job as a limitation. I see it as a funding source. Every paycheck that helped cover web hosting or automation tools was an investment—owner’s equity, not just a side expense. I was backing my own business, not waiting for someone else to believe in it first.

And if you’re in that same season—working full-time while trying to get your idea off the ground—I want you to hear this clearly: That doesn’t make you less serious. It makes you strategic. You’re giving your business the room it needs to grow without forcing it to support you before it’s ready.

That’s a freedom move.

Common Missteps: Confusing the Two

One of the biggest traps I see new entrepreneurs fall into is assuming they’re working toward one goal when they’re actually chasing another. That confusion can create a lot of frustration.

Some people quit their jobs to start a business with the hope that it’ll provide full income right away. Others find themselves out of work unexpectedly and decide it’s time to bet on themselves. I respect that. I don’t knock it. But it’s not what I teach.

I encourage people to build while they’re still working, if that’s an option. Because that paycheck? It gives you a safety net while you’re taking risks. It lets you test, learn, adjust—without the weight of “this has to work immediately or I won’t be able to pay rent.” That space is powerful.

Sometimes, founders stall not because their idea is bad, but because they’re trying to reach a version of success that doesn’t fit their current reality. They think they’re aiming for total independence—walk away from the 9-to-5, full-time income on autopilot—but really, what they want is room to breathe. More control. Less stress. They want freedom, but they’re measuring progress by a different standard.

It’s not about aiming higher or lower. It’s about aiming truer—to what you actually want and need right now.

Matching Your Business Model to Your Goals

If your goal is financial independence—basic needs covered, no job required—you might be looking at a simpler life. Fewer expenses. Lower income targets. Your business model could lean toward one or two streamlined products, minimal overhead, and just enough recurring revenue to meet your living expenses. Think lean and sustainable—not necessarily scalable.

But financial freedom? That’s a different build entirely. It’s not just about survival—it’s about having options. Travel, generosity, fun, flexibility. It’s about not asking, “Can I afford this?” before you say yes to a life experience. That kind of freedom demands a business that doesn’t rely on your constant effort.

It means having the ability to step out of the time-for-money grind—even if you enjoy the work. It means building systems that bring in revenue while you rest, create, or explore. You might still work in your business, but it’s not required for the money to flow. That’s the shift.

A business built for financial freedom prioritizes scalability: digital products, licensing, evergreen funnels, assets that earn while you sleep. Not just for vanity metrics—but because you want the space to live life without money being a leash.

You don’t need to do everything at once. But knowing the difference helps you decide what to build now—and what to build next.

Final Takeaway: What’s Your Version of Enough?

At some point, the lines between financial freedom vs financial independence might start to blur. Maybe you reach a point where you don’t have to work—but you still want to. Or maybe your income grows beyond what you thought you’d need—and now “enough” looks different.

That’s why this isn’t just a budgeting exercise. It’s a values exercise.

What kind of life are you actually trying to build?

Do you want space to rest, or room to grow?

Do you need stability? Flexibility? Adventure?

Is “enough” just about covering the basics—or about having the freedom to say yes to more?

And maybe the most important question of all: If you could stop working today, would your life feel full—or just… quiet?

Then ask: Is your business model designed to support that number—or is it chasing something else?

And if you’re not sure where to start with that reflection, grab The Business Execution Toolkit. Inside, you’ll find The Power Planner—a system that helps you define priorities, break down financial goals, and execute with clarity. Whether you’re aiming for independence or freedom, this tool will keep you focused on your version of enough.