Convenience

Cash is a thing of the past for many consumers. It used to be that people saved their credit cards for big purchases, like airfare or clothes shopping. Nowadays, shoppers are flexing their credit card spending power with smaller purchases. People pay to park with a credit card. In many places, people can even use credit cards pay for snacks and drinks at vending machines. Let’s face it. People have gotten used to swiping cards instead of stuffing bills. When customers can purchase whatever they need with a credit or debit card, there’s little need to carry around cold, hard cash.

What that means for you as a business owner, particularly if you operate out of a physical location, is consumers may only come to buy with one method of purchase–a card. If you’re not accepting credit cards, you’re not open for business to them. As more and more people transition to non-cash purchases, you’ll find you’ll need to make the transitional to accommodate or settle on lost sales.

Online Payments

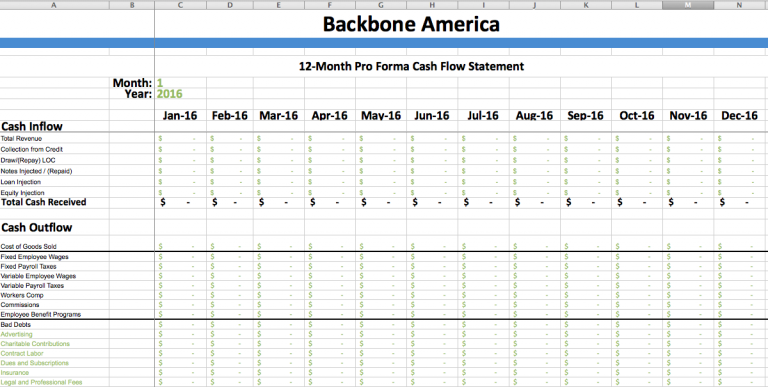

If you use one of the credit card services mentioned above, it can simplify collecting online payments. If you’ve set up your system to integrate with your accounting program, much of your bookkeeping work can be done in one swoop. You can invoice, set up automatic billing, accept payments, and more with your payment processing service. You can even enter cash or check payments manually into your online payment system and have it feed into your accounting system. In essence, these systems can document all your accounts receivables and just make your life that much easier as a business owner.

Depending on how integrated your service is, you can even set up your business account for your accounts payables. But that’s a topic for another day.

Security

Though the security is great for consumers, reversed transactions are not good for you as the merchant. If you’ve delivered goods or services, you may find yourself out of luck when the transaction is reversed. After all, a credit cardholder isn’t responsible for fraudulent purchases, and someone has to pay. It’s important to have good systems in place to protect your business from credit card vulnerabilities.

Processing Fees

You’re going to have processing fees. Companies, like Square, PayPal, and Stripe, aren’t offering their credit card services for free. They’re in it to make a buck, just like you. Their fees in the U.S. can vary anywhere from $.30 + 1.9% of the purchase to 2.7% of the purchase to $.15 + 3.5% of the purchase, or some other variation, depending on the volume and type of transaction (swiping a credit card usually has a lower fee than manually entering a credit card). Some processing services also charge a monthly fee, if you use or signup for services above and beyond their basic features.

The transaction fees don’t seem like a lot on the surface when it comes to being able to offer your customers credit card services. After all, what’s 3 cents on a dollar transaction? You still make $0.97 in profit, right? I’d do that all day. However, you have to be very careful with those smaller sales. Are you really making $0.97 profit? If you’re with one of the companies that also have the $.30 fees in addition to a percentage of the wholesale, your profit margin can be significantly affected. Take for example a $1 bottle of soda. Your transaction fee would come to $0.33, leaving you only $0.67 in profit. Ouch! If your main business is selling sodas, you might find you don’t have a profitable business.

Before settling on a credit card processing service, make sure you know how the numbers will work for your business. You might consider imposing a minimum purchase for credit card sale transactions.

Credit Card Systems

Despite the processing fees, credit card services are a great way to add value to your business. Best of all, most payment processing companies provide credit card readers to merchants for free! That’s right, you don’t have to purchase an expensive system to start accepting credits from your customers.

Keep in mind, the free card reader isn’t some fancy gadget. We’re talking about the kind that connects to your phone. You might see small businesses using them at trade shows or smaller events. If you want something snazzier, you’ll have to purchase an upgrade. With these upgrades, you purchase a system that has a chip reader, which complies with the EMV regulations.

Final Thoughts on Credit Card Services

In today’s American society, we’re big into the “buy now, pay later” phenomenon.” Cash and checks are out, credit cards are in. It’s up to you, as the vendor, to get on board and provide services to customers in the manner they’re shopping. Yes, processing fees take a cut out of the profit. Yes, it requires you to be more vigilant when making the sell. However, if you put the right systems in place, accepting credit cards can be more beneficial than a burden. In fact, it can be a pivotal point in helping your company grow.