How to Get an EIN Number

First of all, I’m going to tell you the question “How to get an EIN number” is rather redundant. Why? Because EIN stands for employee identification number. So asking for an EIN Number is asking for an employee identification number number. I mention that, because I often hear that question. Now that we’ve cleared that up, let’s move through the next steps for starting a small business.

What’s an EIN

The simplest explanation I have for an EIN is that it’s like a social security number but for your business. Other terms you might hear for an EIN is a Federal Employee Identification Number (FEIN) and Tax Identification Number (TIN). So, if you hear or see any of those terms, they’re talking about the same thing.

Who needs an EIN?

In my opinion, anyone running a business should obtain an EIN. Though it’s called employer identification number, it’s rather misleading. Though all employers need to obtain one, employers are not the only ones who should or must have an EIN. The IRS has a checklist identifying those who absolutely must have an EIN. However, even if the IRS doesn’t require it for your business, it’s a good idea to obtain one, for several reason.

In my opinion, anyone running a business should obtain an EIN. Though it’s called employer identification number, it’s rather misleading. Though all employers need to obtain one, employers are not the only ones who should or must have an EIN. The IRS has a checklist identifying those who absolutely must have an EIN. However, even if the IRS doesn’t require it for your business, it’s a good idea to obtain one, for several reason.

- Sometimes when you deal with other businesses and/or organizations, they’ll ask for your tax identification number (TIN). You have a couple of choices. 1) You can provide them with your company’s EIN or 2) you can provide them with your Social Security Number. You remember that thing… the number we’re told to keep secret and protect so we can avoid things like identity theft? Yeah… that one. So, you make the choices.

- Having an EIN for your business is a good step to keeping your business separate from your personal affairs. This is especially important if you’re operating an limited liability company (LLC).

- Finally, it’s a free service the IRS offers and takes maybe 15-30 minutes to complete the online form. If you complete the form online, you receive your EIN right away and can start using it immediately.

How do you get one?

There a few ways you can obtain an EIN. One thing to keep in mind is you can only have one sole proprietor type EIN. That means if you obtain an EIN for as a sole proprietor then try to register a second EIN for another business operating under a sole proprietorship, you’ll application will be rejected. If you’re using the online form, which I’ll talk about next, it won’t let you progress through the program.

There a few ways you can obtain an EIN. One thing to keep in mind is you can only have one sole proprietor type EIN. That means if you obtain an EIN for as a sole proprietor then try to register a second EIN for another business operating under a sole proprietorship, you’ll application will be rejected. If you’re using the online form, which I’ll talk about next, it won’t let you progress through the program.

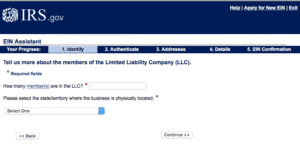

Online. The first way I’ll mention is the online form. It works like a wizard. That is, the online form guides you through each step. A word of caution… request your EIN AFTER you’ve registered your business. I say this because the IRS will allow you to obtain an EIN without setting up a business first. However, if you find you’re not able to register the business name you’ve selected, you’ll have to apply again with your new name. Plus, the IRS only allows you to obtain an EIN with your social security number once through their online system. So, save yourself some time and register your business first. You can obtain an EIN online by following this link.

Fax or Mail. The next way, and less ideal method, to obtaining an EIN is to fill out their paper form. Here, you’ll receive no fancy wizards guiding you through the process. Instead, you’re stuck with instructions (Form SS-4) and the accompanying pdf file. Whereas you receive your EIN immediately with the online option, expect to wait a week if you go the fax route and four weeks if by mail.

Final Thoughts

Best Practice Sign Shows Most Efficient Procedures

As I mentioned, every business owner should have an EIN. Having one helps you protect your social security number, while also keeping your business separate from your personal affairs. Whether or not you have a LLC or a sole proprietor, separation between the accounts is a best practice.

What pros and cons do you see when it comes to obtaining an EIN.

Leave A Comment